Use our signature Fix and Flip loan product to help fund your next flip. Whether you’ve flipped 100 or this is your first time, we provide fast, dependable, proven capital at competitive rates to make your next project profitable.

Want to Buy and Hold? Use the BRRRR Method – Use our capital to Buy, Rehab, Rent, Refinance & Repeat!

or call us at (866) 407-1599

Park Place Finance specializes in residential real estate and can fund various properties in 47 States, with the following Investment Property Types:

Park Place Finance eliminates junk fees and has straight-forward pricing when it comes to fees associated with closing your loan.

You’ll love the ease of closing with Park Place Finance, because of our common sense underwriting. No Tax Returns, No Income Verification, and No Debt Ratio to Qualify! To speed up the process, here’s the main items you’ll need to gather:

Close Fast

(Typically 3-5 Business Days)

Competitive Rates (Rates from 10.99%)

Nationally Trusted (Over 1 Billion Funded!)

We’ve closed over 4,000 loans and have funded over $1 Billion since 2006. We know how to help make sure your next project is profitable with our combined 50+ years of lending experience among our executive team. Call us today to help make your next investment property a success!

Rates and leverage are dependent on risk. Risk is measured on flipping experience, credit, loan details, and loan term. You are able to set your loan term from 6-18 months. The rate and allowable max leverages will be determined on a number of factors including credit profile, experience and project size. Get started today to find out where you qualify. It just takes a couple minutes to submit your application!

Great- there is no pre-payment penalty, so you can pay-off the loan at anytime, without incurring additional fees. Your interest is simply calculated by the days you hold the loan before payoff.

Generally, yes. However, approval of an extension is considered with a few factors including but not limited to, on-time payment history, project status, etc.

We can look at exceptions down to 600 with compensating factors such as experience and additional guarantors.

YES! We love helping first-time flippers. In fact, many of our expert flippers started their first flip financing with us.. With 4,000+ loans closed, we are here to help you with any questions you have including budget reviews, property valuations, and profitability analysis. Our goal is to make your flip a financial success for you!

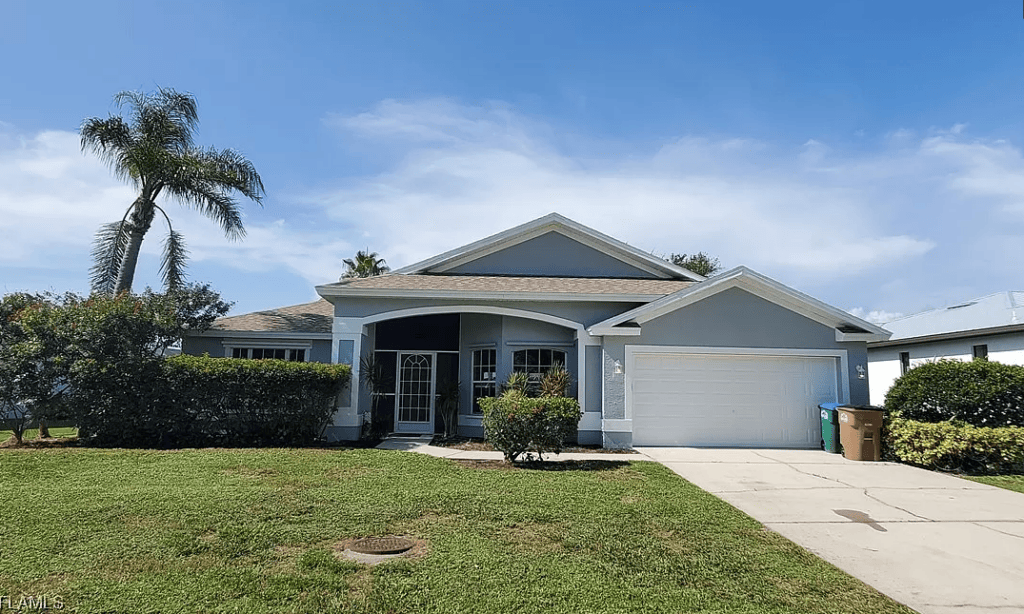

Fix and Flip

Loan Amount: $364,000

Rehab Financed: 100%

LTC: 87%

ARV: 70%

Fix and Flip

Loan Amount: $228,000.00

Rehab Financed: 100%

LTC: 78.62%

ARV: 56.86%