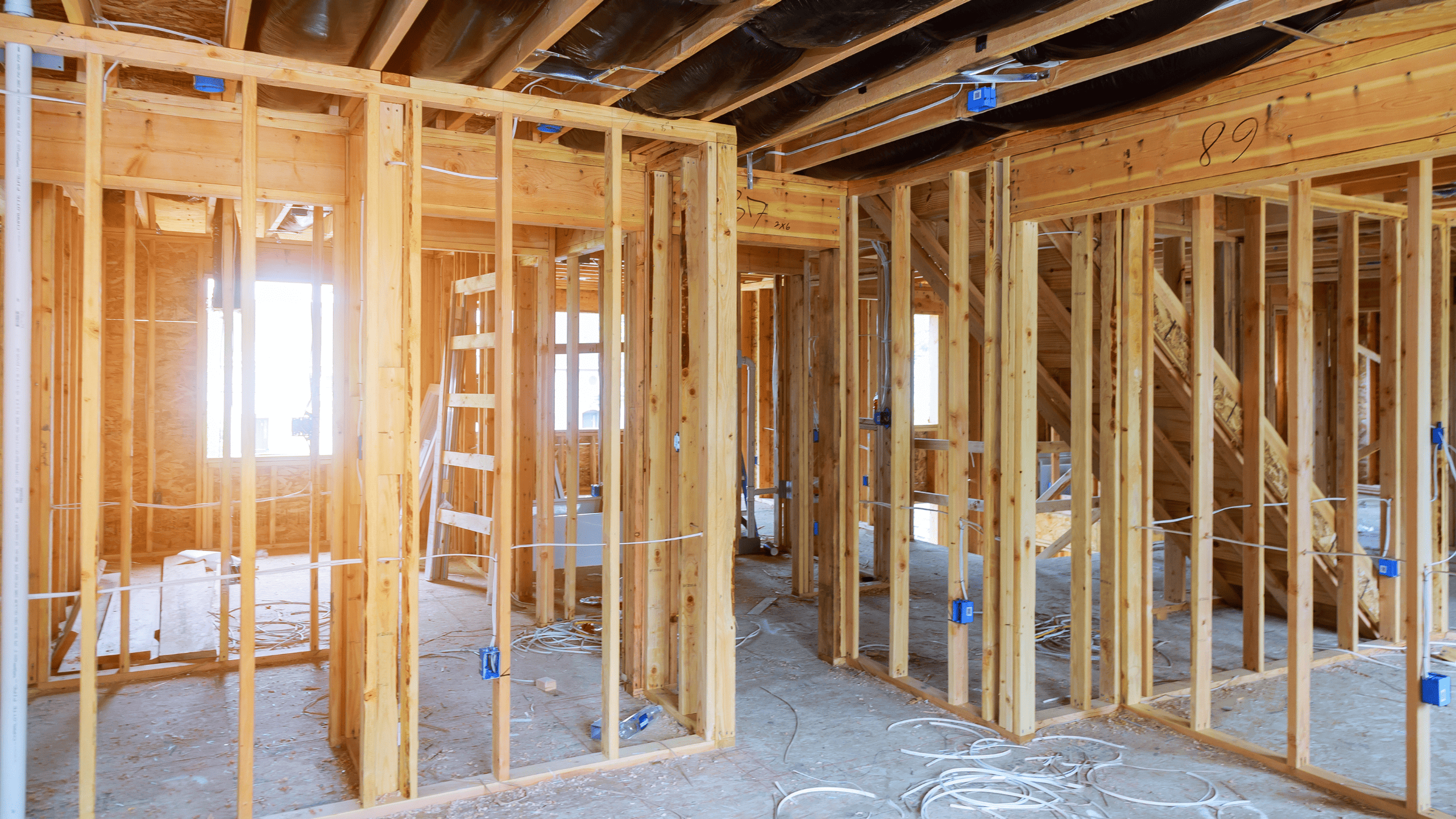

Built for experienced home builders (2-200 homes/year)

✓ Higher leverage than traditional banks

✓ Fast closing process

✓ Competitive rates

✓ Simple, straightforward draws

Fund your next spec home with proven capital that keeps projects on track and profitable.

or call us at (866) 407-1599

Park Place Finance specializes in residential real estate and can fund various properties including:

To close a Ground Up Construction Loan at Park Place, there are a few basic items that you will need to submit to our team. Below is a general list of some of the requirements. Once you apply, you will receive a document portal for easy upload!

Close Fast (Typically 7-10 Business Days)

Competitive Rates (Rates from 9.99% APR)

Nationally Trusted (Over 1 Billion Funded!)

We’ve closed over 4,000 loans and have funded over $1 Billion since 2006. We know how to help make sure your next project is profitable with our combined 50+ years of lending experience among our executive team. Call us today to help make your next investment property a success!

Debt Service Coverage Ratio. This is simply = your total payment / your total rents. If this number is 1.0 or greater, than your rents are higher than your total payment. The higher that is, the better your rate generally is.

The ratio is calculated by dividing the property income (rental income) from the property PITIA (principal + interest + taxes + property insurance+ homeowners association dues). The resulting ratio lets the lender know how much income is available to pay the mortgage. A ratio of 1.0x means that the property that the revenue from rental income AND expenses is equal. A DSCR above 1 means the property is positively cash-flowing. Conversely, a DSCR of less than one means that the expenses exceed the rental revenue and the property has a negative cash-flow.

There’s many reasons clients prefer DSCR loans vs. Conventional financing. First, DSCR loans do not take into account your other debts beyond the PITI payment of your loan. So, if you are self employed and report very little income, using a DSCR loan may be the best option.

Secondly, a DSCR loan does not report to credit, and therefore may not affect your future ability to qualify for additional properties.

Another benefit is that a DSCR loan allows you to vest in an LLC , whereas FNMA does not allow that on traditional financing.

The top 3 factors that affect the DSCR rate include the actual Debt Service Coverage Ratio (DSCR), Loan-to-Value, and your FICO (credit score). The higher the DSCR is on a property, the lender is able to forecast a lower risk for lending the capital since the property may be positively cash-flowing and the investor is able to pay the monthly loan payments. Loan-to-Value, or LTV, refers to the loan amount as it relates to the actual value of the property. Typically, DSCR loans will never exceed 80% LTV. That means that the borrower needs to bring about 20% +closing costs as a down payment for the loan. The lower the LTV, the less risk for the lender, hence a better rate. Finally, your credit score is still a factor when determining the rate. Lenders use the score and it affects the final rate for your DSCR loan.

Rates vary daily, but typically DSCR loans are .5% to 1.5% higher than a Conventional Loan. However, DSCR loans are much easier to qualify for given the fact they do not take into account your personal income.