Ready to finance your first construction project? At Park Place Finance, our Builder Loan is specifically designed for first-time builders like you. We understand the unique challenges you may face, and we’re here to guide you through the process and provide the support you need.

or call us at (512) 774-3582

| Experience | Land | Construction | Max LTC | ARV |

| 0-1 | 0% | 100% | 75% | 70% |

| 2-4 | 50% | 100% | 80% | 70% |

| 5+ | 50% | 100% | 85% | 70% |

Close Fast (TYPICALLY 5-7 Business Days)

Competitive Rates (Rates from 7.25% APR)

Nationally Trusted (Over 1 Billion Funded!)

We’ve closed over 4,000 loans and have funded over $1 Billion since 2006. We know how to help make sure your next project is profitable with our combined 50+ years of lending experience among our executive team. Call us today to help make your next investment property a success!

DSCR

Loan Amount: $897,500

LTV: 67.99%

DSCR Purchase

Loan Amount: $339,750

LTV: 75%

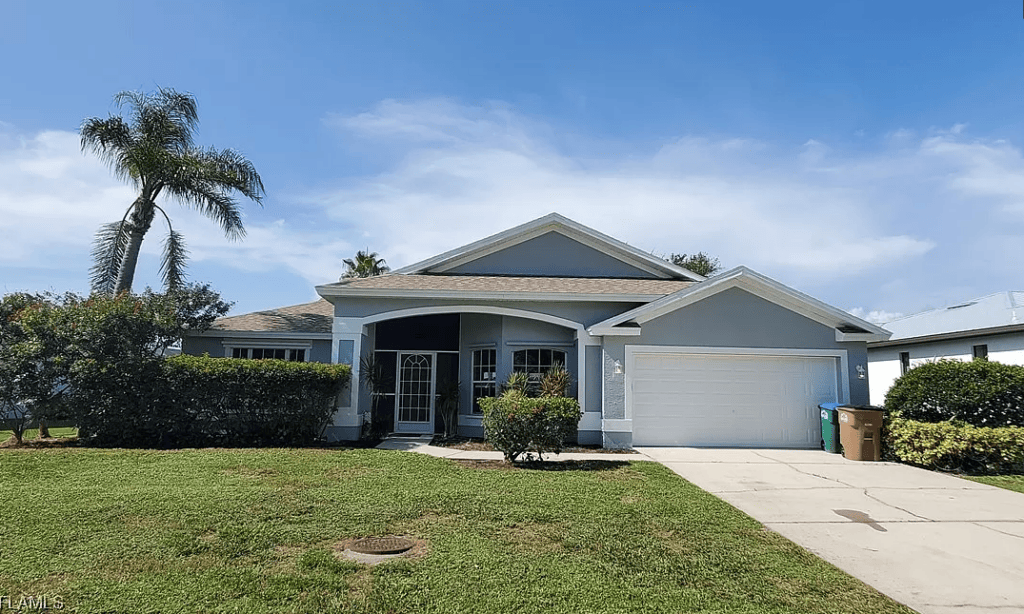

DSCR Purchase

Loan Amount: $114,750

LTV: 75%

DSCR Purchase

Loan Amount: $118,125

LTV: 75%

Fix and Flip

Loan Amount: $364,000

Rehab Financed: 100%

LTC: 87%

ARV: 70%

New Construction

Loan Amount: $195,025

LTC: 72.5%

ARV: 61%

New Construction

Loan Amount: $2,263,500

LTC: 81%

ARV: 73%

Bridge Loan

Loan Amount: $618,870.75

LTV: 75%

Bridge Loan

Loan Amount: $1,380,000

LTV: 80%

Fix and Flip

Loan Amount: $228,000.00

Rehab Financed: 100%

LTC: 78.62%

ARV: 56.86%

Bridge Loan

Loan Amount: $1,600,000

LTV: 58.18%